2023 paycheck calculator

Prepare and e-File your. Ad Compare This Years Top 5 Free Payroll Software.

Tuition And Fees University Of Manitoba

It can also be used to help fill steps 3 and 4 of a W-4 form.

. Welcome to the FederalPay GS Pay Calculator. The first thing you need to know about the Georgia paycheck calculator. IRS Federal Taxes Withheld Through Your.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use SmartAssets paycheck calculator to.

For example if an employee earns. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Sage Income Tax Calculator. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. It can also be used to help fill steps 3 and 4 of a W-4 form.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Kansas paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. As the IRS releases 2023 tax guidance we will update this tool.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The annual Robert Half Salary Guide provides employers and job seekers with in-depth insights into projected starting salaries hiring trends. How to calculate annual income.

The official 2023 GS payscale will be published here as. 2022 Federal income tax withholding calculation. Our 2022 GS Pay.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. Employers can enter an. The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board raise.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. 2023 Wage Benefit Calculator. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

On the other hand if you make more than 200000 annually you will pay. The maximum an employee will pay in 2022 is 911400. Free salary hourly and more paycheck calculators.

2023 Paid Family Leave Payroll Deduction Calculator. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. How do I calculate hourly rate.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Free Unbiased Reviews Top Picks. Employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Georgia Paycheck Calculator 2022 - 2023. Subtract 12900 for Married otherwise.

See where that hard-earned money goes - with UK income tax National Insurance. Get the 2022 Robert Half Salary Guide. See IRSgov for details.

The 2023 Calculator on this page is currently based on the latest IRS data. 2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. Next divide this number from the.

Pay Parity Calculating Your Pay Ece Voice

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

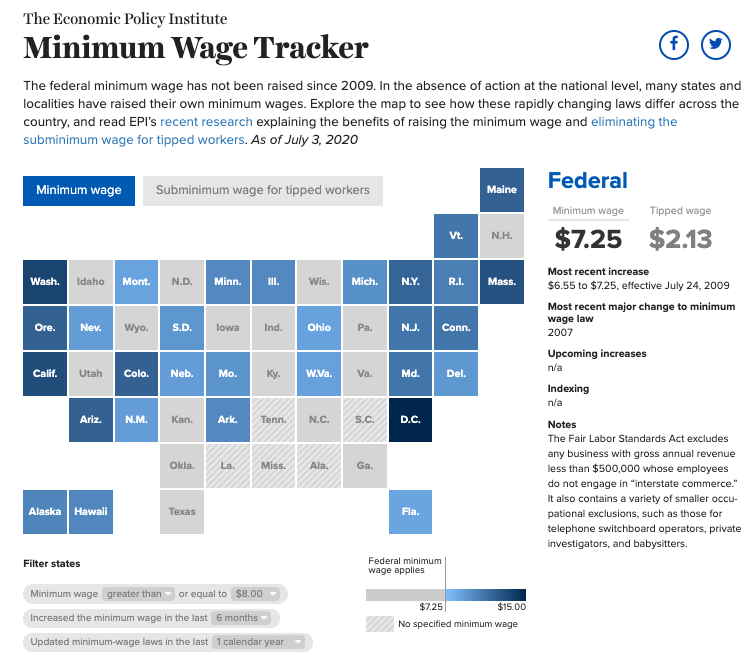

Minimum Wage Tracker Economic Policy Institute

2022 Public Service Pay Calendar Canada Ca

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Projected 2023 Va Disability Pay Rates Cck Law

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

61ffddclnzcvmm

Projected 2023 Va Disability Pay Rates Cck Law

Ts Prc Calculator 2023 For Teachers Employee Salary With New Fitment

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2

2021 2022 Income Tax Calculator Canada Wowa Ca

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

Calculator And Estimator For 2023 Returns W 4 During 2022

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2022 2023 Tax Brackets Rates For Each Income Level